What's your practice worth?

Plus: Super Micro whistleblower alleges retaliation

Accounting is running out of recruits, with program enrollments falling 56% since 2010. To turn things around, regulators want to make CPA licensing more accessible by swapping out that fifth year of school for real-world work experience. Could this change help revitalize the industry?

Plus, this week, The Net Gains sits down with John Jeanson, CFO of Accountalent to get his take on AI, staying up with tax laws and team building.

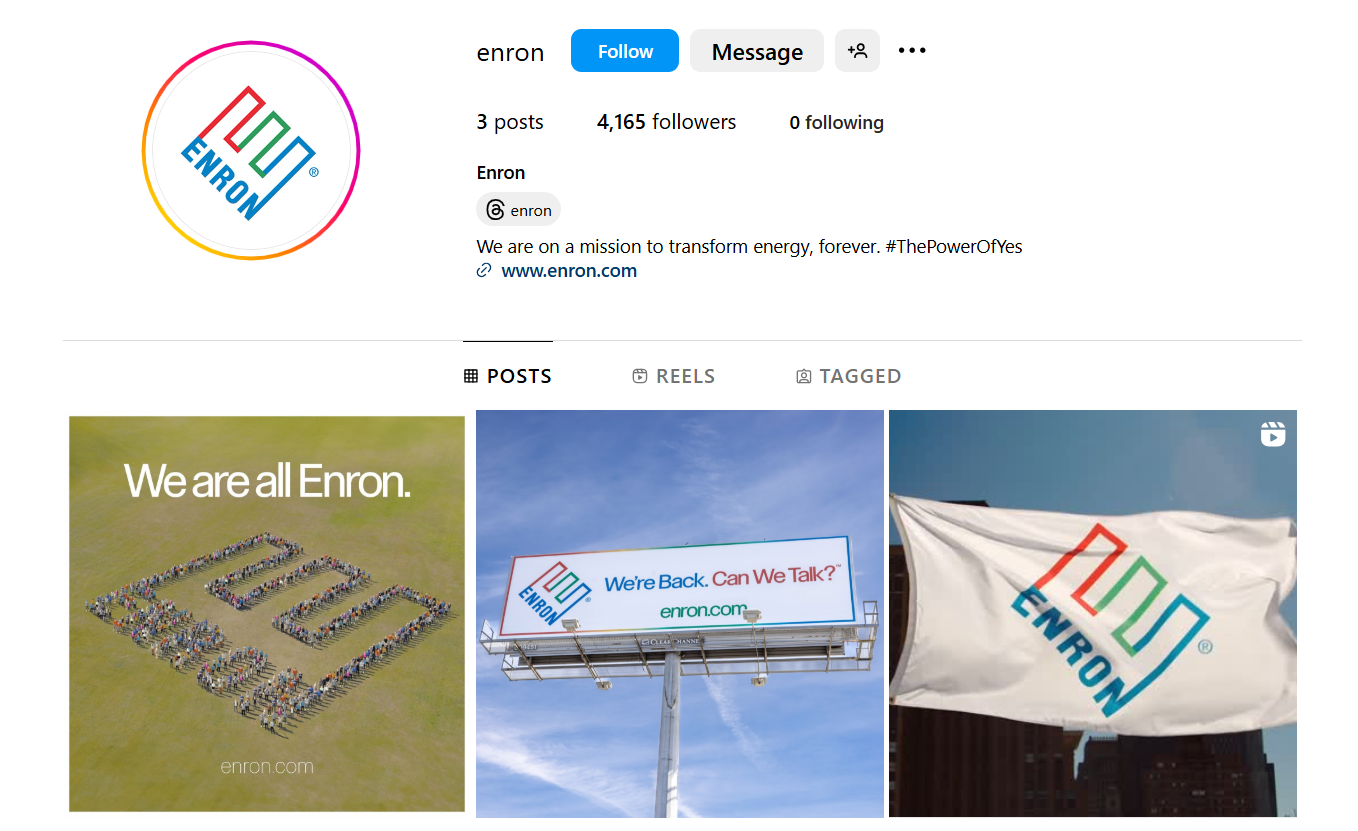

P.S. It's still "too soon," Enron. The long-shuttered company's unexpected parodied return is raising eyebrows, reigniting anger and disbelief among those who remember its infamous 2001 collapse.

The Net Gains had the opportunity to chat with John Jeanson, CFO of Accountalent, a firm specializing in startup tax and accounting, and is heavily involved in supporting innovation and mentorship through partnerships with Ivy League schools like Harvard and MIT. Here, Jeanson, who served as senior director and CFO of L3Harris Technologies prior to joining Accountalent, delves into AI’s impact, compliance strategies, and the enduring importance of cash flow management. -Brent LeBlanc, assistant editor

How do you see AI and automation shaping the future of accounting, and what tools do you recommend for firms to stay competitive? AI and automation streamline tasks like data entry and reporting, freeing accountants to focus on advisory roles. Using LLMs for drafting responses boosts efficiency, while platforms like Puzzle or Rillet reduce manual bookkeeping hours.

With tax laws constantly changing, how do you ensure your team stays current and your clients remain compliant? We prioritize ongoing education for our team by leveraging subscriptions to reputable tax and accounting resources, such as the AICPA, IRS updates, CCH and state-specific tax bulletins. For our clients, we proactively assess their financial situations to ensure compliance, sending out timely updates and conducting regular reviews to mitigate potential issues before they arise.

What is your approach to building a strong, cohesive financial team, and how does that impact the success of your clients? A strong team is built on a foundation of collaboration, continuous learning, and a shared sense of enjoyment in the work. It’s our priority to create a positive and fun work environment, through team-building activities, celebrating wins, and a company culture where everyone feels valued. That translates into better service, stronger relationships, and more creative problem-solving for our clients.

What’s one piece of financial advice you believe every business owner should follow, no matter what industry they’re in? Remember that "cash is king." Cash was king 100 years ago, cash is king now, cash will be king 100 years from now. While profitability is important, cash flow is what keeps a business running day-to-day. A lack of liquidity can quickly derail even the most profitable businesses. Business owners should regularly monitor their cash flow, create projections and maintain a cash reserve for unexpected expenses or opportunities. Ultimately, strong cash flow management provides the flexibility and stability needed to weather challenges, seize growth opportunities, and keep your business on a path to long-term success.

Above: John Jeanson, left, at TechCrunch Disrupt 2024. (Courtesy of Accountalent / LinkedIn)

Whistleblower alleges retaliation after flagging accounting concerns at $20B Super Micro

Ex-Super Micro Computer Inc. director Bob K. Luong is seeking to advance his whistleblower lawsuit, claiming he was fired for flagging alleged accounting violations. His recent court filing claims the company prematurely recorded revenue and shipped incomplete products to inflate financials. The suit also alleges CEO Charles Liang's wife and brother-in-law arranged questionable payment terms with Compuware, a distributor run by Liang's brother that handles Super Micro products in Asia and provides manufacturing services.

Why this matters: The allegations raise concerns about financial reporting accuracy at Super Micro, a major hardware manufacturer. This type of whistleblower lawsuit can attract regulatory scrutiny and impact investor confidence in corporate governance practices. Companies facing such allegations typically see increased costs related to internal investigations, legal defense, and potential settlements. (Yahoo! Finance)

Determine the value of your accounting practice

Poe Group Advisors, an accounting practice intermediary firm in the industry, shares five key factors that determine a practice's worth, based on 20+ years in accounting M&A. Watch to learn how to maximize your firm's selling price.

Why this matters: With record numbers of CPAs reaching retirement age and private equity firms actively investing in accounting practices, understanding firm valuation is critical for buyers and sellers in today's dynamic market. (Poe Group Advisors)

In your accounting era: Gen Z recently took over the AICPA instagram account, and they understood the assignment. Aura points if you can understand anything that was said. No cap.

Is accounting still a good career choice? This Reddit thread has varying opinions on the topic, from "yes it's great," to "get out while you can." What do you think?

Have you seen this? Netflix's Dirty Money is a docuseries that delivers all the juicy details on corporate scandals and shady deals. It aired between 2018 to 2020, and it's worth a re-watch.

Even Santa needs an audit. Packed with dad jokes, The Soul of Enterprise crunches Old St. Nick’s North Pole numbers in this 2021 podcast episode.

$197M

Bonuses Taylor Swift gave to Eras Tour performers, crew. (People)

- Enron makes a comeback. But is it just an elaborate joke?

- EY's approach to building a tech-savvy senior accounting workforce

- Sage unveils AI-powered tools for small business accounting teams

- Platform Accounting Group expands with acquisition of DHS, a NorCal accounting firm

- Accounting loophole hides billions in decommissioning obligations

CPA crisis: Regulators weigh trading books for experience

The accounting profession confronts an alarming decline in new talent, with global enrollment in accounting programs plummeting 56% since 2010, according to the Accounting Talent Index by Advancetrack. This dramatic drop threatens the pipeline of future accounting professionals across the industry. To combat this shortage, U.S. accounting regulators are proposing a significant change to CPA licensing requirements.

Why this matters: The American Institute of CPAs and the National Association of State Boards of Accountancy have jointly proposed allowing work experience to substitute for the traditional fifth year of education. This reform aims to make the CPA path more accessible while maintaining professional standards. (Raconteur)

The Net Gains is your one-stop shop for fresh, FREE accounting insights. You can reach the newsletter team at thenetgains@mynewsletter.co. We enjoy hearing from you.

Interested in advertising? Email us at newslettersales@mvfglobal.com

If you've been enjoying the newsletter, don't keep it a secret. Share it with an industry colleague. (Copy the link here.)

The Net Gains is curated and written by Paul McCormack and edited by Bianca Prieto.